Feature #147

openCustomer Overdue Report

Added by Anil KV about 2 years ago. Updated about 1 month ago.

70%

Files

| clipboard-202503061214-67j2u.png (96.6 KB) clipboard-202503061214-67j2u.png | Theja Ponon, 03/06/2025 12:14 PM | ||

| clipboard-202503061214-mw7gz.png (96.6 KB) clipboard-202503061214-mw7gz.png | Theja Ponon, 03/06/2025 12:14 PM | ||

| clipboard-202503061216-hbm3d.png (96 KB) clipboard-202503061216-hbm3d.png | Theja Ponon, 03/06/2025 12:16 PM | ||

| clipboard-202503201200-35pfp.png (72.1 KB) clipboard-202503201200-35pfp.png | Theja Ponon, 03/20/2025 12:00 PM |

Subtasks

Related issues

Updated by Anil KV almost 2 years ago

GUI Changes:-

1) Currency(Check ledger stmt) - Remove Base2(**) item, Default Emty

2) Debit and Credit Checkbox set after _ Consider Matching Done After To Date_ default Tick all(3) check boxes

3) Add *Consider Not Approved Documents Checkbox - Default Untick

4) Payment Terms row also include more(Expand) div

5) Payment Terms Select box need a checkbox before, Title-Tick ON then allow to Edit, Otherwise take each customers Payment Terms

6) All customer min ledgers load and Tick on all

7) ON and Disable Debit Checkbox

8) List

#

Code

Name

Currency

Current

-Net Balance

-Outstanding Dr

-Outstanding Cr

-Net Outstanding

As On Date

-Net Balance

-Outstanding Dr

-Outstanding Cr

-Net Outstanding

Payment Terms

Outstanding (Note: Consider Consider Matching Done After To Date input)

Due Days

Due Amount

Updated by Anil KV almost 2 years ago

Points

1) Branch and Depart select all then skip where conditions

Currency = Base1(...) Selected Case SQL:-

SELECT ac3.pk_account_id,

ac3.vhr_account_code,

ac3.vhr_account_name,

cu1.dbl_credit_limit,

cu1.sin_credit_limit_based_on,

pt1.pk_payment_terms_id,

pt1.sin_payment_mode,

pt1.sin_next_day_week_month,

pt1.sin_based_on,

pt1.vhr_payment_term_string,

str2.vhr_currency,

(str2.dbl_due_debit + str2.dbl_effective_debit + str2.dbl_debit) AS dbl_debit,

(str2.dbl_due_credit + str2.dbl_effective_credit + str2.dbl_credit) AS dbl_credit,

(str2.dbl_due_outstanding_debit + str2.dbl_effective_outstanding_debit + str2.dbl_outstanding_debit) AS dbl_outstanding_debit,

(str2.dbl_due_outstanding_credit + str2.dbl_effective_outstanding_credit + str2.dbl_outstanding_credit AS dbl_outstanding_credit,

(str2.dbl_due_debit + str2.dbl_effective_debit) AS dbl_effective_debit,

(str2.dbl_due_credit + str2.dbl_effective_credit) AS dbl_effective_credit,

(str2.dbl_due_outstanding_debit + str2.dbl_effective_outstanding_debit) AS dbl_effective_outstanding_debit,

(str2.dbl_due_outstanding_credit + str2.dbl_effective_outstanding_credit) AS dbl_effective_outstanding_credit,

str2.dbl_due_debit,

str2.dbl_due_credit,

str2.dbl_due_outstanding_debit,

str2.dbl_due_outstanding_credit

FROM (

SELECT fk_ledger_id,

vhr_base_currency AS vhr_currency,

SUM(dbl_base_cur_debit) AS dbl_debit,

SUM(dbl_base_cur_credit) AS dbl_credit,

SUM(dbl_base_cur_outstanding_debit) AS dbl_outstanding_debit,

SUM(dbl_base_cur_outstanding_credit) AS dbl_outstanding_credit,

SUM(dbl_base_cur_effective_debit) AS dbl_effective_debit,

SUM(dbl_base_cur_effective_credit) AS dbl_effective_credit,

SUM(dbl_base_cur_effective_outstanding_debit) AS dbl_effective_outstanding_debit,

SUM(dbl_base_cur_effective_outstanding_credit) AS dbl_effective_outstanding_credit,

SUM(dbl_base_cur_due_debit) AS dbl_due_debit,

SUM(dbl_base_cur_due_credit) AS dbl_due_credit,

SUM(dbl_base_cur_due_outstanding_debit) AS dbl_due_outstanding_debit,

SUM(dbl_base_cur_due_outstanding_credit) AS dbl_due_outstanding_credit

FROM (

SELECT tr1.fk_ledger_id,

tr1.vhr_base_currency,

0.00 AS dbl_base_cur_debit,

0.00 AS dbl_base_cur_credit,

0.00 AS dbl_base_cur_outstanding_debit,

0.00 AS dbl_base_cur_outstanding_credit,

0.00 AS dbl_base_cur_effective_debit,

0.00 AS dbl_base_cur_effective_credit,

0.00 AS dbl_base_cur_effective_outstanding_debit,

0.00 AS dbl_base_cur_effective_outstanding_credit,

tr1.dbl_base_cur_debit AS dbl_base_cur_due_debit,

tr1.dbl_base_cur_credit AS dbl_base_cur_due_credit,

CASE WHEN tr1.dbl_base_cur_debit > 0 THEN tr1.dbl_base_cur_outstanding ELSE 0.00 END AS dbl_base_cur_due_outstanding_debit,

CASE WHEN tr1.dbl_base_cur_credit > 0 THEN tr1.dbl_base_cur_outstanding ELSE 0.00 END AS dbl_base_cur_due_outstanding_credit

FROM transaction.tbl_transaction tr1

INNER JOIN accounts.tbl_account ac1

ON tr1.fk_ledger_id = ac1.pk_account_id

WHERE tr1.dat_transaction <= <AS ON DATE>

AND tr1.fk_main_ledger_id IN (1,2)

AND tr1.fk_branch_id = 1

AND tr1.fk_department_id = 1

AND tr1.vhr_sys_module_name IN/NOT IN (???)

AND tr1.sin_posting_status = 1

AND (ac1.sin_ac_category = 18 OR ac1.sin_if_customer = 1)

UNION ALL

SELECT tr2.fk_ledger_id,

tr2.vhr_base_currency,

0.00 AS dbl_base_cur_debit,

0.00 AS dbl_base_cur_credit,

0.00 AS dbl_base_cur_outstanding_debit,

0.00 AS dbl_base_cur_outstanding_credit,

tr2.dbl_base_cur_debit AS dbl_base_cur_effective_debit,

tr2.dbl_base_cur_credit AS dbl_base_cur_effective_credit,

CASE WHEN tr1.dbl_base_cur_debit > 0 THEN tr1.dbl_base_cur_outstanding ELSE 0.00 END AS dbl_base_cur_effective_outstanding_debit,

CASE WHEN tr1.dbl_base_cur_credit > 0 THEN tr1.dbl_base_cur_outstanding ELSE 0.00 END AS dbl_base_cur_effective_outstanding_credit,

0.00 AS dbl_base_cur_due_debit,

0.00 AS dbl_base_cur_due_credit,

0.00 AS dbl_base_cur_due_outstanding_debit,

0.00 AS dbl_base_cur_due_outstanding_credit

FROM transaction.tbl_transaction tr2

INNER JOIN accounts.tbl_account ac2

ON tr2.fk_ledger_id = ac2.pk_account_id

WHERE (tr2.dat_transaction > <AS ON DATE> AND tr2.dat_transaction <= <Effective Date>)

AND tr2.fk_main_ledger_id IN (1,2)

AND tr2.fk_branch_id = 1

AND tr2.fk_department_id = 1

AND tr2.vhr_sys_module_name IN/NOT IN (???)

AND tr2.sin_posting_status = 1

AND (ac2.sin_ac_category = 18 OR ac2.sin_if_customer = 1)

UNION ALL

SELECT tr3.fk_ledger_id,

tr3.vhr_base_currency,

tr3.dbl_base_cur_debit,

tr3.dbl_base_cur_credit,

CASE WHEN tr3.dbl_base_cur_debit > 0 THEN tr3.dbl_base_cur_outstanding ELSE 0.00 END AS dbl_base_cur_outstanding_debit,

CASE WHEN tr3.dbl_base_cur_credit > 0 THEN tr3.dbl_base_cur_outstanding ELSE 0.00 END AS dbl_base_cur_outstanding_credit,

0.00 AS dbl_base_cur_effective_debit,

0.00 AS dbl_base_cur_effective_credit,

0.00 AS dbl_base_cur_effective_outstanding_debit,

0.00 AS dbl_base_cur_effective_outstanding_credit,

0.00 AS dbl_base_cur_due_debit,

0.00 AS dbl_base_cur_due_credit,

0.00 AS dbl_base_cur_due_outstanding_debit,

0.00 AS dbl_base_cur_due_outstanding_credit

FROM transaction.tbl_transaction tr3

INNER JOIN accounts.tbl_account ac3

ON tr3.fk_ledger_id = ac3.pk_account_id

WHERE tr3.dat_transaction > <Effective Date>

AND tr3.fk_main_ledger_id IN (1,2)

AND tr3.fk_branch_id = 1

AND tr3.fk_department_id = 1

AND tr3.vhr_sys_module_name IN/NOT IN (???)

AND tr3.sin_posting_status = 1

AND (ac3.sin_ac_category = 18 OR ac3.sin_if_customer = 1)) AS str1

GROUP BY fk_ledger_id, vhr_base_currency) AS str2

INNER JOIN accounts.tbl_account ac3

ON str2.fk_ledger_id = ac3.pk_account_id

INNER JOIN accounts.tbl_customer cu1

ON ac3.pk_account_id = cu1.fk_account_id

LEFT JOIN accounts.tbl_payment_terms AS pt1

ON cu1.fk_payment_terms_id = pt1.pk_payment_terms_id

WHERE cu1.dbl_credit_limit > 0

AND (cu1.sin_credit_limit_based_on = 2 OR str2.vhr_currency = ac3.vhr_default_currency_code)

AND (str2.dbl_due_debit > 0.00 OR str2.dbl_due_credit > 0.00)

ORDER BY ac3.vhr_account_name;

Currency = Not Base1(...) Selected Case SQL:-

SELECT ac3.pk_account_id,

ac3.vhr_account_code,

ac3.vhr_account_name,

cu1.dbl_credit_limit,

cu1.sin_credit_limit_based_on,

pt1.pk_payment_terms_id,

pt1.sin_payment_mode,

pt1.sin_next_day_week_month,

pt1.sin_based_on,

pt1.vhr_payment_term_string,

str2.vhr_currency,

...str2.dbl_debit,

...str2.dbl_credit,

...str2.dbl_outstanding_debit,

...str2.dbl_outstanding_credit,

...

str2.dbl_due_debit,

str2.dbl_due_credit,

str2.dbl_due_outstanding_debit,

str2.dbl_due_outstanding_credit

FROM (

SELECT fk_ledger_id,

vhr_ledg_currency AS vhr_currency,

SUM(dbl_ledg_cur_debit) AS dbl_debit,

SUM(dbl_ledg_cur_credit) AS dbl_credit,

SUM(dbl_ledg_cur_outstanding_debit) AS dbl_outstanding_debit,

SUM(dbl_ledg_cur_outstanding_credit) AS dbl_outstanding_credit,

...

SUM(dbl_ledg_cur_due_debit) AS dbl_due_debit,

SUM(dbl_ledg_cur_due_credit) AS dbl_due_credit,

SUM(dbl_ledg_cur_due_outstanding_debit) AS dbl_due_outstanding_debit,

SUM(dbl_ledg_cur_due_outstanding_credit) AS dbl_due_outstanding_credit

FROM (

SELECT tr1.fk_ledger_id,

tr1.vhr_ledg_currency,

0.00 AS dbl_ledg_cur_debit,

0.00 AS dbl_ledg_cur_credit,

0.00 AS dbl_ledg_cur_outstanding_debit,

0.00 AS dbl_ledg_cur_outstanding_credit,

tr1.dbl_ledg_cur_debit AS dbl_ledg_cur_due_debit,

tr1.dbl_ledg_cur_credit AS dbl_ledg_cur_due_credit,

CASE WHEN tr1.dbl_ledg_cur_debit > 0 THEN tr1.dbl_ledg_cur_outstanding ELSE 0.00 END AS dbl_ledg_cur_due_outstanding_debit,

CASE WHEN tr1.dbl_ledg_cur_credit > 0 THEN tr1.dbl_ledg_cur_outstanding ELSE 0.00 END AS dbl_ledg_cur_due_outstanding_credit

FROM transaction.tbl_transaction tr1

INNER JOIN accounts.tbl_account ac1

ON tr1.fk_ledger_id = ac1.pk_account_id

WHERE tr1.dat_transaction <= <AS ON DATE>

AND tr1.fk_main_ledger_id IN (1,2)

AND tr1.fk_branch_id = 1

AND tr1.fk_department_id = 1

AND tr1.sin_posting_status = 1

AND tr1.vhr_sys_module_name IN/NOT IN (???)

AND tr1.vhr_ledg_currency = '???'

AND (ac1.sin_ac_category = 18 OR ac1.sin_if_customer = 1)

UNION ALL

SELECT tr2.fk_ledger_id,

tr2.vhr_base_currency, --***1->change to vhr_ledg_currency

0.00 AS dbl_ledg_cur_debit,

0.00 AS dbl_ledg_cur_credit,

0.00 AS dbl_ledg_cur_outstanding_debit,

0.00 AS dbl_ledg_cur_outstanding_credit,

tr2.dbl_ledg_cur_debit AS dbl_ledg_cur_effective_debit,

tr2.dbl_ledg_cur_credit AS dbl_ledg_cur_effective_credit,

CASE WHEN tr1.dbl_ledg_cur_debit > 0 THEN tr1.dbl_ledg_cur_outstanding ELSE 0.00 END AS dbl_ledg_cur_effective_outstanding_debit,

CASE WHEN tr1.dbl_ledg_cur_credit > 0 THEN tr1.dbl_ledg_cur_outstanding ELSE 0.00 END AS dblledg_cur_effective_outstanding_credit,

0.00 AS dbl_ledg_cur_due_debit,

0.00 AS dbl_ledg_cur_due_credit,

0.00 AS dbl_ledg_cur_due_outstanding_debit,

0.00 AS dbl_ledg_cur_due_outstanding_credit

FROM transaction.tbl_transaction tr2

INNER JOIN accounts.tbl_account ac2

ON tr2.fk_ledger_id = ac2.pk_account_id

WHERE (tr2.dat_transaction > <AS ON DATE> AND tr2.dat_transaction <= <Effective Date>)

AND tr2.fk_main_ledger_id IN (1,2)

AND tr2.fk_branch_id = 1

AND tr2.fk_department_id = 1

AND tr2.vhr_sys_module_name IN/NOT IN (???)

AND tr2.sin_posting_status = 1

AND (ac2.sin_ac_category = 18 OR ac2.sin_if_customer = 1)

UNION ALL

SELECT tr3.fk_ledger_id,

tr3.vhr_ledg_currency,

tr3.dbl_ledg_cur_debit,

tr3.dbl_ledg_cur_credit,

CASE WHEN tr3.dbl_ledg_cur_debit > 0 THEN tr3.dbl_ledg_cur_outstanding ELSE 0.00 END AS dbl_ledg_cur_outstanding_debit,

CASE WHEN tr3.dbl_ledg_cur_credit > 0 THEN tr3.dbl_ledg_cur_outstanding ELSE 0.00 END AS dbl_ledg_cur_outstanding_credit,

0.00 AS dbl_ledg_cur_due_debit,

0.00 AS dbl_ledg_cur_due_credit,

0.00 AS dbl_ledg_cur_due_outstanding_debit,

0.00 AS dbl_ledg_cur_due_outstanding_credit

FROM transaction.tbl_transaction tr3

INNER JOIN accounts.tbl_account ac3

ON tr3.fk_ledger_id = ac3.pk_account_id

WHERE tr3.dat_transaction > <Effective Date>

AND tr3.fk_main_ledger_id IN (1,2)

AND tr3.fk_branch_id = 1

AND tr3.fk_department_id = 1

AND tr3.vhr_sys_module_name IN/NOT IN (???)

AND tr3.sin_posting_status = 1

AND tr3.vhr_ledg_currency = '???'

AND (ac3.sin_ac_category = 18 OR ac3.sin_if_customer = 1)) AS str1

GROUP BY fk_ledger_id, vhr_ledg_currency) AS str2

INNER JOIN accounts.tbl_account ac3

ON str2.fk_ledger_id = ac3.pk_account_id

INNER JOIN accounts.tbl_customer cu1

ON ac3.pk_account_id = cu1.fk_account_id

LEFT JOIN accounts.tbl_payment_terms AS pt1

ON cu1.fk_payment_terms_id = pt1.pk_payment_terms_id

WHERE cu1.dbl_credit_limit > 0

AND (cu1.sin_credit_limit_based_on = 1 AND str2.vhr_currency = ac3.vhr_default_currency_code)

AND (str2.dbl_due_debit > 0.00 OR str2.dbl_due_credit > 0.00)

ORDER BY ac3.vhr_account_name;

Updated by Anil KV almost 2 years ago

CS Coding Logic

1) Query Payment teams is null then take GUI Payment teams BASED ON Checkbox ON, Otherwise Apply Input payment team for all customers

1.1) Pass to API GUI Payment teams Payment Mode and Days

1.2) Due days calculate -> DueDate = GlobalFunctions.FnGetPaymentDueDate -> DueDate - Effective date(Input)

2) Find Payment teams and Effective date base Due days and Due amount Calculate

3) Effective Date > As on date - other wise block

4) Outstanding Column Value is dbl_due_outstanding_debit-dbl_due_outstanding_credit(If Credit Checkbox ON)-After As on Date matched amount(If checkbox OFF)

Updated by Anil KV almost 2 years ago

- Status changed from New to Open

- % Done changed from 0 to 10

Updated by Junaid M almost 2 years ago

- Status changed from Open to Ready for Coding

- Assignee changed from Junaid M to Amal Siby

- % Done changed from 10 to 20

Updated by Amal Siby almost 2 years ago

- Status changed from Ready for Coding to Coding Started

- Start date changed from 02/02/2023 to 02/07/2023

- % Done changed from 20 to 40

Updated by Amal Siby almost 2 years ago

- Status changed from Coding Started to Particialy Coding Done

Pending To Do

-----------------

Search to Do based on( Credit Limit, Credit Limit based On) According to New Changed In Customer

Updated by unnikannan S almost 2 years ago

- Status changed from Particialy Coding Done to Reopen Bugs

- % Done changed from 40 to 50

- Tested By set to unnikannan S

ISSUE FOUNDED

1.UI CRASHING WHILE SELECTING MODULE

2.DROP DOWN ICON MISSING WHILE SELECTING ALL IN MODULES

3.WHILE CHOOSING CURRENCY SHOWING OPTION US 2 MORE

Updated by Amal Siby almost 2 years ago

Bug Fixed.

Pending To Do

-----------------

Search to Do based on( Credit Limit, Credit Limit based On) According to New Changed In Customer

Module Sorting.

Updated by Amal Siby over 1 year ago

- Status changed from Reopen Bugs to Reopen Bugs Coding Done

- % Done changed from 50 to 60

Module Completed.

Updated by Seema Mathew over 1 year ago

- Status changed from Reopen Bugs Coding Done to Reopen Bugs

- % Done changed from 60 to 50

- Tested By changed from unnikannan S to Seema Mathew

ISSUE FOUNDED****

1.PAYMENT TERMS DATA MUST BE IN PRINT.

2.MISSING ERASER FILTER TAB.

Updated by Amal Siby over 1 year ago

- Status changed from Reopen Bugs to Reopen Bugs Coding Done

- % Done changed from 50 to 60

Updated by unnikannan S over 1 year ago

ISSUE FOUNDED

1.SHOW ACT US CLIENT A/C'S DATA (BASED ON CONSIDER FILTER)

2.SHOW DATA BASED ON SELECTING PAYMENT TERMS ITEMS WITHOUT CHECK BOX

Updated by unnikannan S over 1 year ago

- Status changed from Reopen Bugs Coding Done to Reopen Bugs

- % Done changed from 60 to 50

- Tested By changed from Seema Mathew to unnikannan S

ISSUE FOUNDED

1.SHOW DATA AS PER CHOOSEN PAYMENT TERMS BY CUSTOMER ONLY

2.EFFECTIVE DATE IS MANDATORY

3.OUTSTANDING=UP TO AS ON DATE:NET OUTSTANDING

4.ADD A BLANK OPTION FOR PAYMENT TERMS FIELD

5.REDUCE CURRENCY COLUMN WIDTH IN LIST

Updated by Anil KV about 1 year ago

New Change

=> Bill Submission - checkbox default untick

=> Payment Terms - checkbox default untick

=> Currency Default - Ledger Currency

=> Payment Terms Default Blank

=> Bill Submission - selectbox(2nd) - default blank

=> popup LedgerSummaryPupup - list Icons click

=> Bill Submission

=> Select 'As On Date' then disable and Empty - Bill Submission(Multiselectbox, Selectbox and Checkbox) - Red *

=> Select 'Base Date' then enable Bill Submission(Multiselectbox-Tick all, Selectbox(Empty) and Checkbox((Untick))) - Remove *

=> 'Base Date*' set last month end date - default, Effactive date - Current date

=> Add Customer input(Code and Name)

=> SQL and Logic

--'Base Date' or select a Bill Submission Term No and all customer then create each 'Bill Submission Term' Bill Submission Date(<='Base Date') list [(Bill Submission Term No, Bill Submission Date), ...]

--'As On Date' then create a 'Bill Submission Term' Bill Submission Date(='As On Date') list [(NOT NULL, 'As On Date')]

--LOOP ALL [(Bill Submission Term No, Bill Submission Date), ...]

-- UNION - IF Not empty

SELECT ac.pk_account_id,

MAX(ac.vhr_account_code) AS vhr_account_code,

MAX(ac.vhr_account_name) AS vhr_account_name,

--Bill Submission Date::Date(input string to date object) AS dat_bill_submission

MAX(cus.fk_payment_terms_id) AS fk_payment_terms_id,

MAX(cus.sin_bill_submission_term) AS sin_bill_submission_term,

--MAX(cus.sin_no_of_submission_days) AS sin_no_of_submission_days,

MAX(cus.sin_grace_period) AS sin_grace_period,

MAX(exd.sin_extra_days) AS sin_extra_days,

MAX(tr.vhr_ledg_currency) AS vhr_ledg_currency,

SUM(tr.dbl_ledg_cur_debit) AS dbl_ledg_cur_debit,

SUM(tr.dbl_ledg_cur_credit) AS dbl_ledg_cur_credit,

SUM(tr.dbl_ledg_cur_outstanding) AS dbl_ledg_cur_outstanding,-- dbl_ledg_cur_dr_outstanding, dbl_ledg_cur_cr_outstanding

SUM(tr.dbl_base_cur_debit) AS dbl_base_cur_debit,

SUM(tr.dbl_base_cur_credit) AS dbl_base_cur_credit,

SUM(tr.dbl_base_cur_outstanding ) AS dbl_base_cur_outstanding -- dbl_base_cur_dr_outstanding, dbl_base_cur_cr_outstanding

FROM transaction.tbl_transaction tr

INNER JOIN accounts.tbl_account ac

ON tr.fk_ledger_id = ac.pk_account_id

INNER JOIN accounts.tbl_customer cus

ON ac.pk_account_id = cus.fk_account_id

LEFT JOIN (SELECT fk_account_id,

SUM(sin_extra_days) AS sin_extra_days

FROM creditlimit.tbl_extra_limit

WHERE dat_effective_from >= '2024-03-01' AND dat_effective_to <= '2024-03-30' --'2024-03-01'->Bill Date, '2024-03-30'->Effective Date

GROUP BY fk_account_id) exd

ON ac.pk_account_id = exd.fk_account_id

WHERE cus.fk_payment_terms_id IS NOT NULL --IF INPUT THEN Not need

AND cus.sin_bill_submission_term = 1 --IF INPUT and ALL CUSTOMER then Not need

--AND tr.dat_transaction <= Bill Submission Date

--Input based WHERE add

GROUP BY pk_account_id, vhr_ledg_currency -- vhr_ledg_currency not need Currency != Ledger Currency

--IF Calculation Based On == Outstanding

-- Consider considerMatchingDoneAfterEffectiveDate

Updated by unnikannan S 9 months ago

- Status changed from Testing Started to Reopen Bugs

- % Done changed from 60 to 50

ISSUE FOUNDED

1.Error While Search With Bill Date

2.Syntax Error While Changing Calculation Based On

3.Missing Main Ledger While Focus Out From Customer Code

4.Error While Clearing Default Value From Bill Submission Date No

Updated by Junaid M 7 months ago

- Status changed from Testing Done to New Changes

- % Done changed from 90 to 50

Workflow Changes [03/10/2024]

---------------------------------------------------------------------

Customer, Supplier Master:

1. In System Tab -> Credit Limit Based On -> Add validation, If "Credit Limit Amount" is given then "Credit Limit Based On" is mandatory.

Extra Credit Limit/Payment Days

---------------------------------------------------------------------

1. Split Extra Limit widget. Add Currency as label on right side

Customer Overdue/Supplier/Staff Overdue Report

---------------------------------------------------------------------

1. Add title if there is a star mark on widgets.

2. Add blank option in currency select box In Search filter area

3. Workflow change:- -> If Chooses Currency = "Ledger Currency" then only show overdue of accounts in which credit limit is set based on "Account Currency"

-> If Chooses Currency = "Base1 Currency" then only show overdue of accounts in which credit limit is set based on "Base Currency"

-> If Chooses Currency = "Individual Currency" then only show overdue of accounts in which transaction currency is selected Currency.

-> If Chooses Currency = "Blank Currency" option then only show overdue of accounts in all currency

Updated by Arathy PS 5 months ago

- Status changed from New Changes to Reopen Bugs

NEW CHANGES DONE

---------------------------------------

1. Add an additional column 'Total Due Amount' with title: total due upto the end of bill period, also add title for due amount.

2. Add an option on the constrain: 'Overdue based on total due amount'(default tick) add title.

ISSUE FIXED

--------------------------------------------------

1. Data showing when calculation based on: 'debit & credit outstanding net' or 'debit & credit net' is selected and only credit entry is present for the selected as on and effective date then data is showing.

Updated by Arathy PS 4 months ago

- Status changed from Reopen Bugs Coding Done to New Changes

- Assignee changed from Vivekp V to Augustin Jose

- % Done changed from 70 to 50

NEW CHANGES

-------------------------------------

1. The data in 'calculation based on' field should appear based on the admin settings.

Updated by Augustin Jose 4 months ago

- Status changed from New Changes to New Changes Coding Done

- % Done changed from 50 to 70

Updated by Arathy PS 4 months ago

- Status changed from New Changes Coding Done to New Changes

- % Done changed from 70 to 50

New Changes

--------------------------------

1. Three new fields are added in the payment terms--Submission Date, Corporate Approved (Submission), Corporate Approved (Invoice).

-- Make corresponding changes here also

-- Discuss with vivek and anil

Updated by Augustin Jose 2 months ago

- Status changed from New Changes to New Changes Coding Done

- % Done changed from 50 to 70

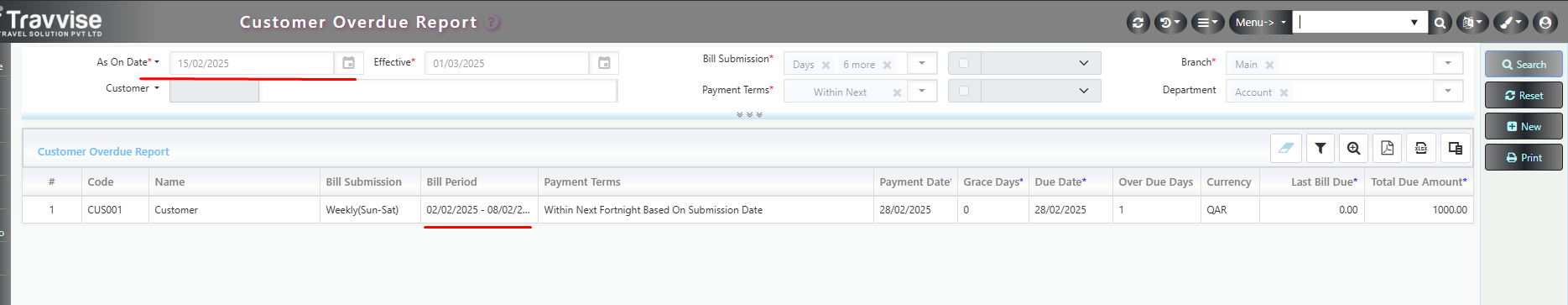

Updated by Theja Ponon about 2 months ago

- File clipboard-202503061214-67j2u.png clipboard-202503061214-67j2u.png added

- File clipboard-202503061214-mw7gz.png clipboard-202503061214-mw7gz.png added

- File clipboard-202503061216-hbm3d.png clipboard-202503061216-hbm3d.png added

- Status changed from New Changes Coding Done to Reopen Bugs

- % Done changed from 70 to 50

Issue Found

----------

1)Only showing single customer when same payment terms set for two customers

2)Incorrect value in Bill period

Updated by Augustin Jose about 2 months ago

- Status changed from Reopen Bugs to Reopen Bugs Coding Done

- % Done changed from 50 to 70

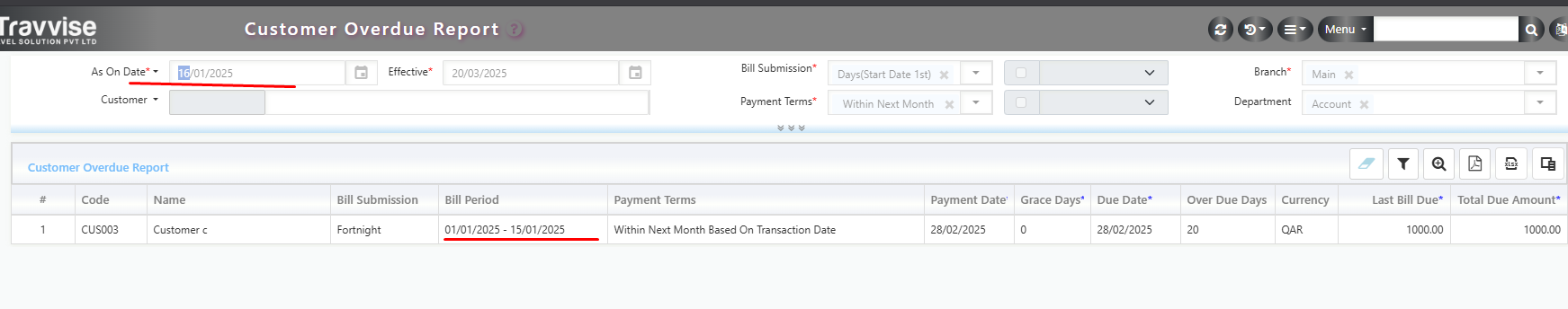

Updated by Theja Ponon about 1 month ago

- File clipboard-202503201200-35pfp.png clipboard-202503201200-35pfp.png added

- Status changed from Reopen Bugs Coding Done to Reopen Bugs

- % Done changed from 70 to 50

Issue Fixed

---------

1)Data is not getting when giving as on date at the end of bill period

Updated by Augustin Jose about 1 month ago

- Status changed from Reopen Bugs to Reopen Bugs Coding Done

- % Done changed from 50 to 70